Asia Fact Check Lab: Is the U.S. economy on the brink of collapse?*

In Brief

Chinese netizens and state media claim that low savings rates and rising credit card debt indicate the U.S. is on the brink of a major financial crisis.

On Jan. 20, Guyan Muchan(孤烟暮蝉), an ardent Chinese nationalist and influential internet personality with more than 6 million followers, quoted a U.S. blogger on the popular social media platform Weibo, stating that "many banks in the U.S. are unable to withdraw cash and have not explained why."

Jiemian, an online business newspaper owned by the state media company Shanghai United Media Group, published a report stating that Capital One, a large U.S. bank, had begun massive layoffs. The report, later reposted by several other Chinese news outlets, quoted Zero Hedge, a far-right financial news blog saying that the U.S. economy is on the brink of collapse.

Asia Fact Check Lab’s (AFCL) review of original Federal Reserve data and reports released by U.S. banks themselves show the above statements to be false.

![]()

Screenshot from the influential Mainland Chinese blogger Guyan Muchan’s Weibo account.

In Depth

Did U.S. banks steal their customers" money?

On Jan. 18, 2023, TikTok user Smashdatopic posted a short video taken at a Bank of America (BOA) branch where 10 customers were waiting in line. In the video, Smashdatopic claims that $1,400 from his account had disappeared and that BOA representatives could not explain why. He then asked if another customer had lost money, before finally saying, "And this is crazy, this is very crazy. Yes, Bank of America decided to take people’s money without their consent."

That same day, several posts from Twitter Users Marisol Mendez and Weather,man also questioned how money they transferred from Zelle, a digital payment system used by BOA, to their bank accounts had disappeared, posting screenshots of their mobile bank accounts as evidence. U.S. Sen. Elizabeth Warren tweeted about the controversy soon after. "@BankofAmerica and @Zelle are apparently failing customers again, with money somehow disappearing from accounts. This should be fixed immediately and customers should be compensated,” said Warren, a Massachusetts Democrat and member of the Senate banking committee.

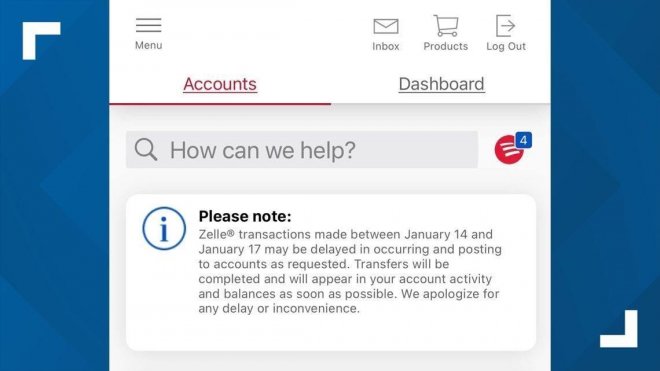

BOA apologized to its customers later that day. "Zelle transactions made between January 14 to 17 may be delayed in occurring and posting to accounts as requested,” the bank said in a statement. “Transfers will be completed and will appear in your account activity and balances as soon as possible. We apologize for any delay or inconvenience."

![]()

Screenshot of the BOA apology to customers.The controversy quickly died down in the U.S., but in China the incident was rebranded by nationalist netizens as an example of the precarious state of the American economy.

On the evening of Jan. 20, the influential Weibo blogger Guyan Muchan reposted Smashdatopic’s video, adding a comment that "many banks in the U.S. are unable to withdraw cash and have not explained why." Some Weibo users noted that Bank of America does represent the majority of banks in the U.S., but most of the comments suggested that the U.S. economy was about to collapse.

AFCL recently visited several BOA branches to interview customers and staff. No one reported continued problems with withdrawals.

Is the U.S. economy on the brink of collapse?

Mainstream Chinese media outlets have also focused on a potential recession of the U.S. economy.

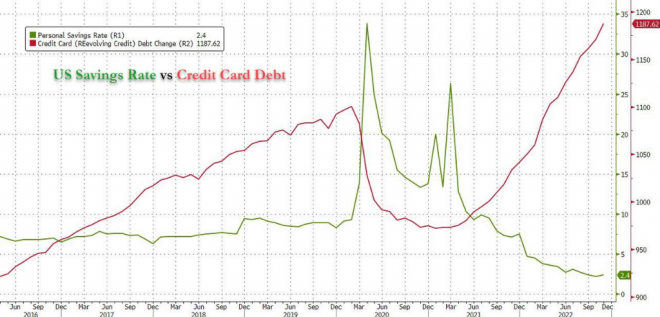

Jiemian, an online business newspaper owned by the state media company Shanghai United Media Group, published a report on Jan. 20 under the headline: "U.S. Customers Can"t Take It Anymore: Savings Rate at an All Time Low, Credit Card Debt and Interest Rates at All Time Highs, Banks Expect Debt to Surge." The report cited data by the far-right financial news site Zero Hedge on high credit card debt and low savings rates, comparing the U.S. economy to a powder keg ready to blow.

![]()

Graph by Zero Hedge of U.S. residential bank savings rates and credit card debt from 2016-2022, cited by Jiemian.The

Jiemian report cites recent mass layoffs at Capital One as proof that banks are struggling. "The scheduled layoffs of over 1,100 jobs might extend to the company"s technology division," the report states.

But that claim is false, AFCL found. Capital One itself is not laying off employees due to mass defaults on loans. Rather, the company plans to transfer 1,100 employees from one department to another in order to adjust the company"s internal workflow, the bank has said.

AFCL also found Zero Hedge’s data and commentary to be misleading, particularly its comparison of post-2020 credit card debt to that of the levels around the time of the 2007-2009 Great Recession.

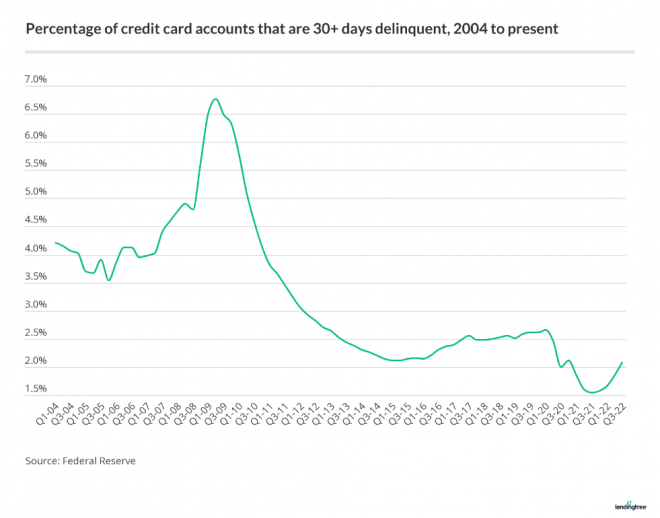

Federal Reserve data shows that while the debt ratios of U.S. credit card users in 2022 have risen similarly to those around 2009, the key 30-day delinquency rate has remained low at around 2% – well below both pre-epidemic levels and the recent peak of more than 6.5% during the Great Recession.

Lendingtree, a U.S. online lending platform, recently released data that show a clear decline in credit delinquency rates. Though there has been a recent uptick, delinquency rates remain well below where they have been over the past two decades.

![]()

Historical data on the 30-day delinquency rate of U.S. credit cards. (Chart: lendingtree)An August 2022 article published on Weiyang Wang, a doctoral research platform and subsidiary of Tsinghua University’s Institute for Fintech Research, delves more deeply into the reasons behind the large swings in personal savings rates over the last fifty years of U.S. history.

The article notes that after sitting at around 10% for several years, savings rates spiked to a high of 33.7% following COVID’s outbreak in April 2020. Researchers attributed the rise to a natural sense of heightened caution during a crisis and the big bump in government financial support through various economic stimulus packages, along with an overall reduction in consumption as people spent more time in their homes. The post-COVID “decline” in savings rates was in reality a return to pre-COVID levels.

Conclusion

In the aftermath of COVID, both Chinese internet personalities and official media have distorted news about U.S. savings rate fluctuations and credit card debt in order to spread false propaganda about an imminent collapse of the U.S. banking system. U.S. economic officials have struggled to contain inflation, but employment and growth rates have remained strong.

Asia Fact Check Lab (AFCL) is a new branch of RFA, established to counter disinformation in today’s complex media environment. Our journalists publish both daily and special reports that aim to sharpen and deepen our readers’ understanding of public issues.

| 喜歡這篇嗎?快分享吧! |

前一頁

後一頁

Screenshot from the influential Mainland Chinese blogger Guyan Muchan’s Weibo account.In Depth

Screenshot from the influential Mainland Chinese blogger Guyan Muchan’s Weibo account.In Depth Screenshot of the BOA apology to customers.The controversy quickly died down in the U.S., but in China the incident was rebranded by nationalist netizens as an example of the precarious state of the American economy.

Screenshot of the BOA apology to customers.The controversy quickly died down in the U.S., but in China the incident was rebranded by nationalist netizens as an example of the precarious state of the American economy.  Graph by Zero Hedge of U.S. residential bank savings rates and credit card debt from 2016-2022, cited by Jiemian.The Jiemian report cites recent mass layoffs at Capital One as proof that banks are struggling. "The scheduled layoffs of over 1,100 jobs might extend to the company"s technology division," the report states.

Graph by Zero Hedge of U.S. residential bank savings rates and credit card debt from 2016-2022, cited by Jiemian.The Jiemian report cites recent mass layoffs at Capital One as proof that banks are struggling. "The scheduled layoffs of over 1,100 jobs might extend to the company"s technology division," the report states. Historical data on the 30-day delinquency rate of U.S. credit cards. (Chart: lendingtree)An August 2022 article published on Weiyang Wang, a doctoral research platform and subsidiary of Tsinghua University’s Institute for Fintech Research, delves more deeply into the reasons behind the large swings in personal savings rates over the last fifty years of U.S. history.

Historical data on the 30-day delinquency rate of U.S. credit cards. (Chart: lendingtree)An August 2022 article published on Weiyang Wang, a doctoral research platform and subsidiary of Tsinghua University’s Institute for Fintech Research, delves more deeply into the reasons behind the large swings in personal savings rates over the last fifty years of U.S. history.